Porters is a software company serving the staffing and recruitment industries. The company boasts excellent SaaS metrics, competes in a niche with a lot of legacy customized on premise systems and inefficient paper process, and has a leading position. Classic VMS. The company can probably continue to grow its topline 15-20%/yr for many years, already boasts 25%+ margins, and could potentially expand into ASEAN further extending its growth runway. The company trades for 10x trailing core earnings, 2x revenue, and 1.6x ARR. It trades at 1.5x 2025 ARR and 8x 2025 core earnings. The company could potentially 4-7x its customer count.

Business

Porters sells workflow software for staffing firms and recruitment firms. While the company is ~20 years old, they have been working on a SaaS product since 2012. This is basically a CRM system that manages both labor/recruits and clients. While this would get lumped in with broader HR software, there is a more existential driver to adopting it, which is that a staffing or recruiting firm’s revenue is an outcome of how efficiently and productively they manage what is otherwise a HR department function more removed from the user paying their bills at the end of the day. There are additional business running aspects that make it a distinct vertical, such as contract management, invoicing, or summaries that get sent to a customer.

ARPU is JPY123k/yr (~$800) and 95% of revenue is recurring. The product is sold by a direct salesforce to ~2,000 companies and ~14,800 users. The company has a lot of white space given that potential customers are often not using modern SaaS products and workflows are increasingly digitized across Japan. Churn rate by number of IDs is negligible, while there is minor churn by number of companies – some companies fail to adopt the software, but those that do seem to remain and/or grow their usage.

A notable aspect of Porters, based on how they present their product and the specifics seen in reviews, is the customizable nature of the forms in the product. This is more important in the vertical than the horizontal aspect of HR software, because a recruitment or staffing business will be handling a wider range of clients, ever changing parameters, industries, and requirements in the normal course of business. This isn’t that unique, but it has enabled Porters to unlock the flywheel of being able to address the widest range of customer use cases, which fuels detailed case studies demanded by Japanese customers, which subsequently attracts more customers. Below is a more detailed description of what the software does from a case study. This is a better solution for an underserved industry, on premise incumbents are especially frustrating in this regard, and it is engrained into the daily workflow of customers.

Numbers

The entire job placement and staffing industry in Japan employs around 423k people per an industry report. The company considers this entire workforce to be their current TAM, which is potentially ambitious. AI tells me 70-80% of employees at staffing firms are focused on recruiting, implying 303-338k users. If the market for IDs is only half the industry workforce and Porters eventually achieves 50% market share, that implies 75-100k users, which would imply JPY9-12bn of potential revenue compared to 15k users and JPY1.9bn in revenue currently. The company launched a subsidiary in 2024, KIKAN, that will focus on back office software for the industry as well, so the TAM is conceivably everyone in the industry if you adopt a 5-10+ year time frame.

In an interview with the CFO on the recruitment page of the company, he says he is focused on the company being 10x larger, including international customers, so there is a strong growth orientation at the company. This isn’t explicitly stated in their investor communications. They don’t need capital and they are already profitable, so I am less inclined to dismiss the 10x comment as pure bluff, albeit it is still meant to influence talent acquisition.

The company has an abundance of growth opportunities in deepening its product suite to raise ARPU, winning market share against legacy players and excel heavy workflows, and expanding into ASEAN. The Japanese economy overall is not the most exciting due to demographic headwinds, but this has caused a big shift away from lifetime employment. Since workers are increasingly likely to move jobs, the recruitment market may experience a slower decline rate than the overall population.

Management

Management identified a large pool of unmet demand and has a logical growth strategy for making money out of it. Most of this assessment is based on them saying things that make sense and having a track record to substantiate that they are doing what they are saying they are doing. They do not have a scattershot approach. Porters has a massive growth opportunity, and the company has a demonstrated focus and forward looking strategy on pursuing it.

Reading between the lines, management demonstrates a strong understanding of how the internet is used to play the broader game. They have good reviews on Openwork.jp (4.07). They’re also a small firm looking to grow at high rates, so being able to convince candidates to join is especially important in a very tight labor market.

They also do well on ITreview.jp in terms of the number of reviews and their rating. Porters’ target customers are likely to do their own research around which product to buy, as customers are not that large and probably lack much in the way of an IT department, so this is an important element of acquiring customers. The gulf between them and peers seems too great to be purely gamesmanship, but even if it were then it is a realpolitik recognition of the reality of the market for both employees and customers (I’m half-cynical here).

Porters produces a magazine for the recruitment industry, which isn’t too notable but is a further indication that the management team is trying multiple ways to get in front of potential customers and build recognition. They claim annual circulation of 168,000. The contents are mostly interviews with people who work at recruiting firms. I suspect there is a Japanese subtext here around establishing contact and deepening relationships with potential customers, as cold calling is less common of a sales tactic in Japan. Japanese business relations require trust built up over time, and I suspect the magazine is a way of projecting a strong presence in the industry it serves.

Looking at competitors with similar marketing content attempts is a positive endorsement of Porters management. MatchingGood’s Dispa, which is online only SEO oriented content, contrasts to Porters’ interviews with industry people. UTS also has an “online magazine,” but it is mostly SEO slop, in addition to a long running magazine for which they charge JPY30,000/yr. Others approach this marketing channel with slightly less finesse - SEO slop is ultimately pointless, and charging for what is really marketing seems penny wise but pound foolish. The interviews are useful to the interviewee, potentially useful to the reader, and demonstrate some basic Cialdini Influence technique well (social proof).

Management is cultivating unique sales funnels into the recruiting and staffing industries of other countries. This piggybacks on Japanese companies having operations throughout the region, as well as Japan wanting to attract migrants to its domestic workforce. Porters is standing up or acquiring recruitment websites in Southeast Asian countries (Indonesia, Bangladesh, Thailand, Malaysia) to host job listings for jobs with Japanese companies and/or in Japan. These acqui-hires (Thailand, Bangladesh) and investments (Bangladesh, Indonesia) gain them a Japanese person who already understands the local market and a low cost capital light business that is already operating in the same industry as Porters. This is a self-aware bridge that allows management to gain expertise and relationships in the country in a digestible way, as they hope to use these to localize their core software product. These markets are poorly served by software, but simply offering software neglects how every country has different labor laws, practices, and customs that are better incorporated into the software before attempting to sell it. This dilutes margins in the short term but creates a lot of optionality at a low cost as these could be shut down without changing the core business in Japan. While I have not done a deep dive in the recruiting and staffing software available in these markets, I suspect that it is largely overlooked by the global players and looks closer to the Japanese market in terms of paper or legacy on premise software processes.

Competition

Competition comes primarily from MatchingGood and UTS. Both do not have a strong internet presence but have the most number of customers and users in terms of competing software in Japan. Porters has the lowest pricing, which I would interpret differently if they didn’t have the most SaaS customers. Based on what I have been able to find, Porters has the best combination of factors that should drive it from strength to strength.

MatchingGood

MatchingGood sells a similar core system for recruitment and staffing companies. They are a subsidiary Brainlab, which is a subsidiary of ZigExgen, a serial acquirer of mostly job listing websites. Brainlab also operates CareerPlus, for recruitment agencies, but based on the limited information on the site, I believe they are essentially folded into MatchingGood. Pricing is JPY22,000/mo/seat with no implementation fee and no stated discount for a 10+ users. There is a 14 month payback on going with Porters over MatchingGood for one employee and less than three months if you have five, but price per seat drops to 7,500 after 10 employees for Porters, so even quicker for larger companies. They also rate poorly as an employer on openwork.jp with a 3.07 score.

MatchingGood claims 1,300 customers compared to 2,000 for Porters. They also have 60 employees compared to ~77 at Porters (Brainlab, the parent co, has 74 as of early 2024 , unclear where the delta occurs). They regularly put on seminars to advertise to customers, so they should be considered a credible and serious competitor. Other than the price difference and fewer customers, they’re also buried in a somewhat decentralized corporation whose focus is a little more spread out. An odd point is that the leading software review site, ITreview.jp, has basically no reviews of Brainlab/MatchingGood/CareerPlus products, especially compared to Porters.

Porters already has more customers. I suspect Porters wins out due to focus, an easily calculated better long term price structure, more visible online reviews and the people in charge able to get rich off success specifically in the staffing and recruitment software space. I would be far less confident in a leadership team that has already cashed out and is part of a broader capital allocation corporation that is less likely to fund reinvestment back in the business. Leadership is also unlikely to have an owner mindset, because they are no longer owners.

UTS

UTS is the legacy on premise provider. UTS at points mentions 3,000 customers. While this is more customers than Porters, they are an on premise provider, which has negative implications for iterating improvements and cost efficiency. The product was first released on CD for Windows XP. They say they are the number one player in core systems for the human resources industry, although they seem to quote a 2018 survey for this. They also note negotiations with 250 staffing companies every year, which gives some insight into the growth opportunity.

They launched a cloud version in recent years. As of December 2021, the cloud product has 236 companies and 3,176 users (for dimensions, assume 40%/yr user growth and they could be at 8,714 users as of the end of 2024, still less than Porters). They have 40 designers on staff, which is slightly more than Porters, but their focus is divided and partially devoted to maintaining an on premise code base. They have a de minimis presence on openwork.jp and get a 2.99 rating, so I also suspect that they lack a workforce that is competitive and nimble enough for a SaaS world. It should be noted that they are not public, which also is a minor hindrance for attracting customers and employees.

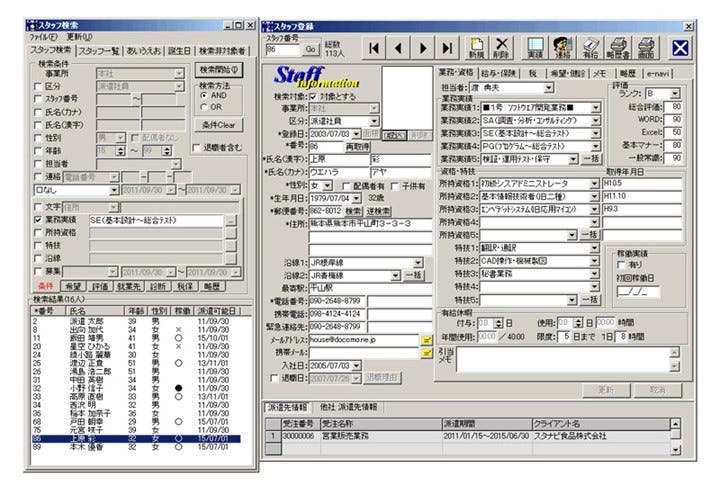

Here is a picture of what their on premise StaffNavi looks like, as well as more information from an ERP system reseller, which also indicates StaffNavi is sold by SIers, an additional layer between the company and its end users that impacts the speed of feedback loops. While the website says it was released for Windows XP, these forms look like Windows 95 based on the blue ribbon headers.

UTS, which is somewhat worrisome as an incumbent with on premise experience, charges a lot more than Porters for their SaaS product. Their pricing is JPY20,000/mo for the first 10 licenses and then 10,000/mo for the 11th and onwards, a 33% premium to Porters. The initial cost is also 150,000. There are add ons that can cost 5-10,000/mo as well. This doesn’t include hosting which costs another 250,000 install and 55,000/mo in maintenance, if I understand the pricing correctly (this may be for cloud hosting of their on premise system, which is distinct from the SaaS system).

Vincere

Vincere has a decent online presence, judged by itreview.jp presence, but their 5 case studies are abysmal single paragraphs each. This is a failure on Vincere’s part, because Japanese purchasing patterns typically begin with reading case studies and then reaching out to the company for more information. According to Linkedin, Vincere’s APAC offices are in Singapore and Australia, which would explain their poor localization efforts. Vincere’s Japanese pricing is not publicly available, but the internet shows £85/month/seat, which is ~JPY16,000. Vincere claims ~2,000 customers and ~22,000 users globally, which is nearly equal to Porters’ customer count in Japan alone, although slightly higher than Porters’ 14,800 users. Vincere competes globally, which I suspect makes Japan a strain on resources and a distraction rather than a real opportunity. They are a small part of The Access Group’s recruitment software business, since 2022, which implies an additional lack of focus.

Others

Lixas, a domestic SaaS competitor appears to also charge JPY1,500/mo/seat for 1-5 users, but has fewer reviews and it is unclear how they are positioned to serve larger customers. They also have an incredibly meager case study section and a generally less informative website. CastingOne has raised ~$6m, but only has 4 case studies on their website. They haven’t had a seminar since July 2024 and pricing is not available on their website. I suspect that these are startups that failed to gain traction and unlikely to threaten Porters in the future.

Risks

AI

“Find me candidates that meet these criteria using linkedin.” This is only part of the staffing and recruitment process and arguably the easiest part that is laborious anyway. Recruiting and staffing is a very human intensive process that involves interacting with job candidates to discuss matters that may be hard to make legible. Candidates need to be convinced on the merits of a job, recruiters need to sift through applicants to avoid wasting the time of customer with bad leads, and companies care more about the problem being solved than how exactly it is solved. Staffing firms similarly solve aggregation problems that will involve paperwork with candidates and labor law compliance. These are middlemen roles that job seekers and employers aren’t equipped to handle. None of this is to say AI won’t have an impact, but I believe that middlemen handling a complicated tasks are beneficiaries of technology rather than threatened by it. Porters with an aligned management team that has already demonstrated forward thinking abilities, existing customer relationships, and modern software product, seems in the best position to be the AI-enabled software provider in this vertical.

Governance

The CEO, age 62, owns ~57% of the shares (913,000 shares). The EVP, age 51, owns ~10% (164,000). This is an illiquid and tiny company. So far it looks like they are public to bolster their credibility with customers and for recruiting – they listed very close to the minimum number of shares to have a compliant float with the Tokyo Stock Exchange. They also just announced that they are going with a 5 person accounting firm instead of the KPMG affiliate they had been using previously, primarily on the basis of cost. This is basically a private company.

They seem to have not been getting enough attention from KPMG and didn’t like paying a Big 4 price. I can understand this feeling, but it is probably short sighted. Here is the precise wording (via google translate):

Although the current accounting auditor has a sufficient system in place to ensure that accounting audits are conducted appropriately and appropriately, the Company has come to the conclusion to change the accounting auditor after comprehensively considering the appropriateness of the audit response and audit fee level for the scale of the Group's business.

The company may fail to garner any investor interest because of the low float and lack of dividend. The valuation is low enough and shrinking where this is more of an opportunity cost issue if the company is hostile to shareholders. Hikari Tshushin showed up with a 20,000 share stake (~1.27%) in the H1 24 report, so the company is not entirely unknown. The company has barely been public for 3 years and reinvesting in growth, so there is still time for the company to announce plans on a dividend before one reaches a conclusion about their stance towards shareholders. The company is not reclusive, demonstrated by informative earnings presentations and hosting an earnings call.

Macro

The recruiting and staffing industry can flex its workforce during a downturn, which means that the software is potentially more volatile than a more binary ERP deployment or a pure theory VMS. The model of charging by the seat means that users can flex up and down depending on the economy. The demographics of Japan make it that there is probably a worker shortage even in a recession, but that may not hold true in the short term. The Kikan investment is encouraging because it should generate revenue more independently of seats. My general observation of staffing and recruiting firms in the US or Europe is that they prefer to hold on to staff for the upswing, which would also make sense with Japanese labor law that tend not to make layoffs too pleasant.

Competition

Existing companies may get their acting together. UTS has a cloud product that is an upgrade from their on premise solutions. MatchingGood may benefit from access to greater resources through their parent company. This is all worth monitoring but has yet to have a meaningful impact on Porters. Porters has already demonstrated they have an attractive product, so they will likely be able to capture a meaningfully greater market share than they currently have. Porters may also eventually pull from profit pools in broader ASEAN markets, which would be an advantage over UTS and MatchingGood. I also think that MatchingGood has a far less incentivized management team given that they don’t have direct equity in the company anymore. Zigexgen is also a capital allocation program, which means that MatchingGood is competing for capital with acquisition opportunities, which makes long term investments like Porters in Bangladesh, Indonesia, or Kikan not nearly as frictionless.

Global companies may try to enter the market. The recruiting and staffing industry is relatively homogenous in terms of workflows. Japan, which does have unique business practices, is probably not on the priority list for companies still focused on the US or Europe. More so than explicit localization of the product, a new entrant would also need to support a range of case studies and seminars with potential customers who may already be using a good enough (cloud SaaS) product. Porters already has thousands of customers, many of which are small, and serves them through a direct sales force, which also makes this market a slog to enter.

Valuation

For reasons discussed elsewhere, the out year power law distribution is more likely in Japan than observed elsewhere. This is not close to being reflected in the valuation of the company, which itself is very low relative to the already demonstrated high growth and margins. As previously covered, the management team seem high quality, a discernable competitive lead has been established, and the end market is underserved by modern software.

There are 1.68m fully diluted shares. The share price is 1,900. The market cap is JPY3.2bn. There is JPY800m of net cash, so the enterprise value is JPY2.4bn. This works out to an EV/ARR of 1.25x and a forward multiple of 1.06x using their estimates, or 1.68/1.43x without giving credit to the cash. I prefer the latter and it seems low.

Envelope math. It is not unthinkable for Porters to be doing 10bn of revenue in 10 years (15% topline CAGR) with mature operating margins of 30-40%, which works out to 2.1-2.8bn of net income. A 4x in revenues would be from a 4x in IDs, currently 14.88k. This implies 59k IDs in 2035, even though there are potentially 400k IDs in the staffing and recruiting market.

If Porters can reach ~100k IDs in the next decade. That would imply a 7x in revenue, or ~13.3bn of ARR, which translates into 3.2bn of net income at 35% ebit margins. If they hit 200k IDs, that is 6.4bn of net income. This also assumes flat ARPU. Cool cool cool.

The Present

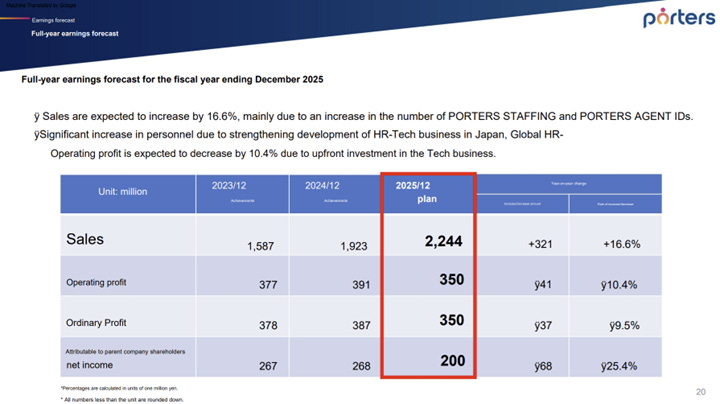

If you want to obsess over a single year of earnings, you can. Earnings are understated due to startup costs for their Bangladesh operation. Applying the ~25% EBIT margin achieved in 2024 (technically 26.2%), excluding startup costs, to Q4 ARR of 1.9bn implies current earnings power 475m of EBIT, or 320m of net income. That is how I arrive at the core earnings power.

Applying a core business ebit margin of 25% of the 2.24bn revenue forecast for 2025 (the start up business isn’t charging fees yet) implies 560m of ebit and 390m of net income. The growth investments look obvious, moat deepening, and growth runway expanding. The margin normalization helps give us a grounded sense of paying an undemanding price, which sets up great potential over the next 10 years as the growth investments bear fruit.

The company’s free cash flow in 2024 was hampered by capitalizing intangibles. This is genuinely for a business that does not currently generate any revenue, Kikan, which will in essence be core software for the staffing industry. I am comfortable with this because the core business that I am valuing on an ongoing basis is distinct from this – e.g. this is very explicitly a growth investment that could be turned off tomorrow and not impair the prospects of the existing business. They historically have not capitalized intangibles either, so historical operating margins are reflective of cash margins. The risk that the Porters capitalized software is a dud is mitigated by a couple of factors – the product development being capitalized can easily be cross sold to existing customers given the industry expertise of the direct sales force the company already employs and have relationships with potential customers, and the competing tool is very likely paper or excel based and takes up needless time spent on nonrevenue generating tasks at the customer.

To further emphasize the point – the targeted growth in 2025 of seats and a small uptick in ARPU will not be because of Bangladesh or Kikan. There is still a core business that is highly profitable and growing independent of the expensed or capitalized investments. They do appear to be spending a little more on growth of the core business in 2025, so depending on how thinly you want to slice things you can ding the core operating margins from 25% to 20% or whatever.

Conclusion

Porters has 14.8k customers that they already profitably serve. They could have 1-2-300k customers at some point in the future, as early evidence points to them having the most focused strategy of offering modern workflow software to the Japanese staffing and recruitment industry. Competition is presently weak, a situation unlikely to change given the IT ecosystem dynamics in Japan. Porters could eventually have even more customers if nascent efforts to enter Southeast Asia yield success. High inside ownership supports confidence in the long term execution of the company’s strategy, while governance unknowns should be balanced with the recent step change in Japanese corporate governance norms.

Maaku out.

I adored this pitch. Bookmarked it and plan to read again. Lots to learn.

Is there a known path of SaaS companies going from serving only Japan to developing localized offerings for Southeast Asia, or would Porters be first?