TVE is a Japanese company trading below cash with a profitable niche business making valves for nuclear power plants. The company trades at a discount to tangible book value, only recently announced plans to take the stock price into consideration, and Hikari Tsushin has a 23% stake in the company. The combination of rock-bottom valuation, earnings inflecting due to Japanese nuclear plants coming back online, and commercially motivated shareholder creates many ways to win.

Business

Nuclear plant valves are a secure niche. TVE generates ~60% of revenue from replacement parts, inspection, and maintenance at nuclear plants. There are 33 operable nuclear plants in Japan. If my cursory research is recent, 12 have restarted as of October 2024, 5 more have passed review to restart, and another 10 are under review to restart. Not all of the dormant ones may be restarted – Japan has been more open to starting pressurized water reactors (PWR), but less so boiling water reactors (BWR), although some BWR have passed review to restart. TVE is strongest in PWR valves, which have fewer obstacles to restarting (Okano Valve is the leader in BWR). The company’s valve are found in other high pressure high temperature applications - chemical (general, hydrogen, ammonia), and thermal power (natural gas, coal, biomass). They also do some business in China, Taiwan, and South Korea.

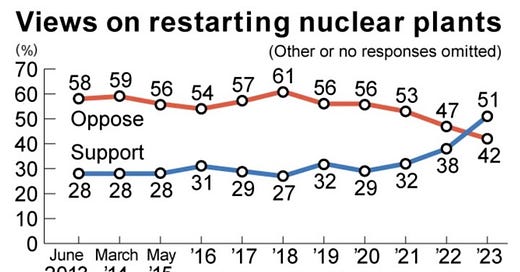

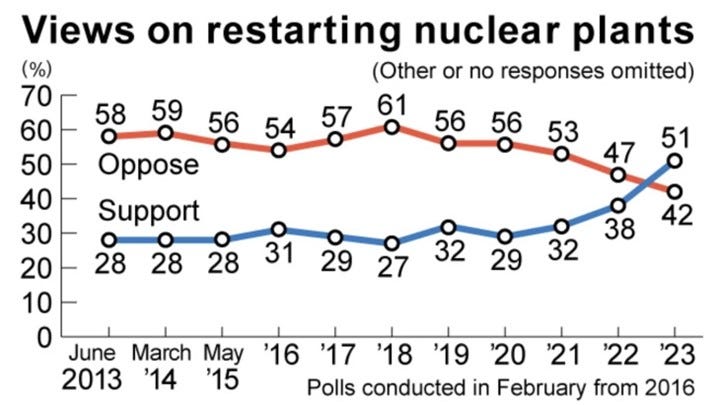

Restarting nuclear plants is self-evidently sensible economically and politically feasible in Japan, so this is not an open ended bet with uncertain timing. Nuclear support is gathering further steam as AI and environmental concerns increase desires for a reliable and low emission power source. It also appears that every country wants domestic AI computing capabilities, which may further push restarting nuclear power plants wherever they exist. The AI angle here is marginal, because there is already interest in restarting the plants, but nevertheless supportive.

TVE is aligned with Seika, both of which are aligned with Mitsubishi Heavy Industries. Seika had been a smaller shareholder for years and then recently increased their stake as Kitz, another valve maker and shareholder, sold their holding in TVE to Seika. Seika launched its nuclear power business in 2023 and has acquired valve companies in the past. This potentially puts TVE in its crosshairs for a full takeover. Hikari Tsushin’s stake mitigates the risk of a take under, but their profit motive likely indicates that they have no special affinity for holding TVE shares for the sake of it. I suspect either increased capital returns or an acquisitions gets us to 1x tangible book value sooner rather than later.

Valuation

The shares trade at ¥2,200. There are 2,340,411 shares outstanding for a market cap of ¥5.1bn. This compares to ¥5.3bn of net cash and ¥1.8bn of investments. Net current assets plus investments less total liabilities are ¥8.3bn. Tangible book value is ¥10.5bn after taxing ¥1.1bn of unrealized gains on securities at 30%.

For 2024, TVE is forecasting ¥10.3bn of revenue and ¥600m of EBIT, which translates into ¥192 of EPS and a valuation of 11x earnings. For scope – in FY10, the last year before Fukushima, the company generated ¥1.6bn of EBIT on ¥10.8bn of revenue, a 14% margin.

Reported earnings in 2024 have benefitted from the reversal of a charge taken in 2023. I believe the forecast represents the ongoing business without the charge reversal as EBIT has been ¥1.1bn through Q3 FY24 (September). The company has a money losing steel making segment (large format cast products), whose losses are increasingly more than offset by a growing electrical business (electrical and fire extinguishing equipment installations targeting BWR nuclear plants - “paging Sir Martin Franklin-san”). While the forecast potentially understates the earnings power, the reported number undoubtedly overstates it.

TVE has a very robust balance sheet, indicative of a pre-Abenomics corporate mentality. Similar to restarting nuclear plants, steps are potentially underway that should see this value recognized in the share price. The company has made nondescript announcements about corporate value and Hikari Tsushin, a Japanese conglomerate with an investment portfolio, owns 23% of the company. While the announcement was light on details, it increases the probability of further positive announcements (the company had already reduced one cross holding in July 2023, so there is some thaw). The shares are illiquid and did not move in the aftermath of the company’s July 2024 announcement to get the company to 1x book value.

Conclusion

This is a very cheap business with several ways for the share price to increase – improved governance, earnings growth, or a fair priced takeout.