Overview

Serverworks sells a dominant, essential, and recurring product in an underpenetrated market – Amazon Web Services in Japan. Serverworks is in the top tier of the AWS partner program and a top rated employer in Japan, which likely solidifies their position reselling AWS in Japan for many years to come. Growth spending that is part of a Strategic Collaboration Agreement with Amazon is compressing margins, which are likely to start expanding again in 2025 and revert to their prior 6%+ already achieved in prior years. The company trades at 15x trailing normalized earnings and ~12x NTM normalized earnings while the top line grows at 30%+ without requiring capital. The CEO is incentivized (~33% owner) and demonstrably long term oriented.

Investment Setup

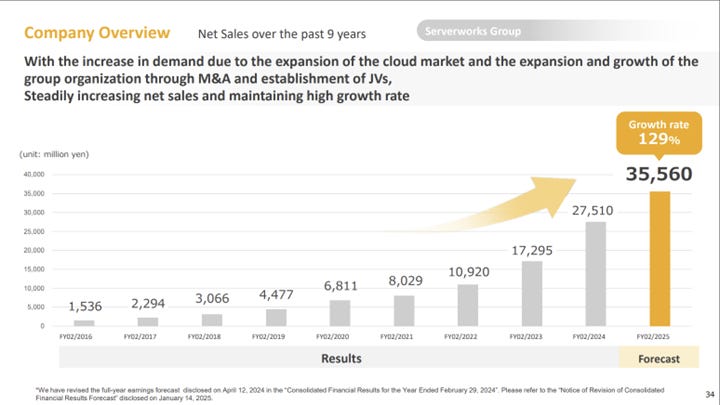

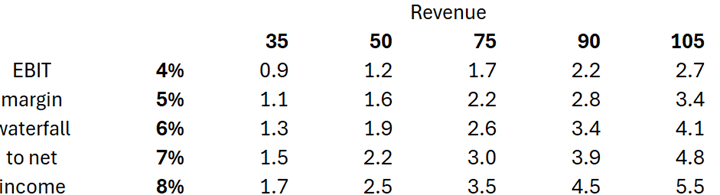

The company has a JPY20bn market cap and JPY9bn enterprise value after backing out cash and investments. They are on track to do JPY35.6bn of revenue in FY2/25 at depressed margins, with forecasted EBIT of 994m, a 2.8% EBIT margin. At normalized margins of 6%, they would be generating JPY1.3bn of net income for a valuation of 15x normalized earnings.

In the next few years, it is possible for Serverworks to generate a >6% EBIT margin on JPY75bn of revenue, which would translate into ~JPY3bn of net income. This implies 21% topline growth over 4 years, which is below the current trend for the industry and the company. The company has abundant growth opportunities up to and beyond 2030, which could justify a high multiple on the earnings as well as patience with lower profits in the short term. While a 6% target seems prudent, there is the potential for the company to earn higher margins, which presents some additional upside optionality.

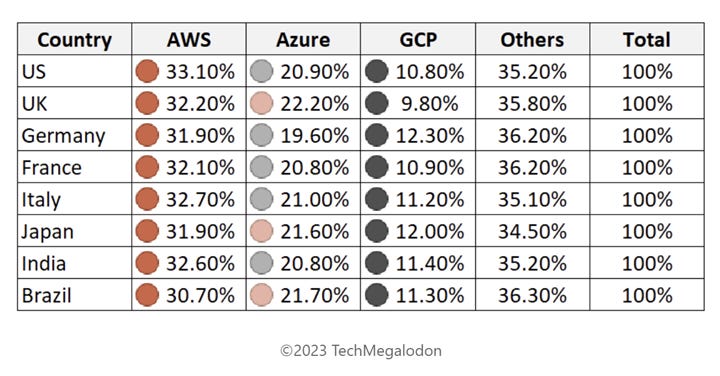

This is not an excel fantasy invited by promotional management. The company has demonstrated its ability to earn higher margins and a fundamentally proven distribution business model for a dominant rapidly growing product. AWS is the leading cloud provider (~32% share, 50% bigger than the next largest competitor) in Japan. Japan is several years behind cloud adoption from the US, which itself has still maintained a high growth rate in cloud spending. Even a transition to a multicloud approach isn’t an issue for Serverworks, as they have a GCP business that is quickly growing at 56% YoY and accounts for ~20% of consolidated revenue (Serverworks owns 50% of the company, which operates as G-gen).

There is no uniquely Japanese equivalent where AWS’s market position and economic proposition can be circumvented, which is visible in cloud market share data. In a specific example, there are 5 approved government cloud providers for public agencies in Japan, as of October 2024 1,452 out of 1,497 systems are using AWS. It’s also worth noting that of the 5, the only provider yet to be used is the only Japanese company on the list, which has $400m of assets on its balance sheet and is also pursuing an AI data center business. As of January 2025, Sakura has only met 11 out of 119 requirements set by the Digital Agency, which also highlights the advantage AWS has as an already established and standard setting player. NTT, Fujitsu, and Softbank round out the top 6 in Japan cloud market share but are ultimately not challenging AWS for the top spot.

Serverworks is spending in advance of additional growth, which has high visibility and is being done in a business model with high recurring revenue that does not expose the company to sudden air pockets in demand. AWS is likely to continue growing in Japan overall and Serverworks still has a lot of customers very early in their adoption cycle. As existing customers continue to ramp up spending, the relative cost of a growth orientation (sales force, onboarding/migration support) should decrease. A direct AWS reseller competitor, Classmethod, already has 8.5% EBIT margins on 77bn of revenue, further indicating a 6% margin is not a stretch. Serverworks does not have to come close to that high of a margin for the shares to be undervalued.

A very crude model that sees them compound the topline 15%/yr until FY35 would see cash build of ~JPY38bn (100% FCF conversion, no net tangible assets) and a market value of JPY73bn if exiting at a 12x earnings multiple on 6% EBIT margins. This combined value of JPY111bn compares favorably to the current JPY20bn market cap.

Business

Serverworks helps Japanese companies run their software on the cloud as a reseller of Amazon Web Services, and Google Cloud Products to a lesser extent. They layer on additional services as well, such as being a managed services provider (MSP), which is a higher margin business line. Reseller is an understatement, as Serverworks takes on a lot of responsibility for a company’s IT, as many Japanese companies lack a full IT department and there is an acute shortage of AWS savvy engineers. Serverworks is as much an intermediary for AWS to end users as it is from end users to AWS, from a technical and cultural perspective, as their explanation of the business makes clear:

What distinguishes us is "resale." Customers may think, "Why not just buy Amazon's cloud directly from Amazon?" However, if customers actually want to buy cloud directly from Amazon, they have to prepare a corporate credit card and pay in dollars, which is a fairly high hurdle.

If you have this done through our company, you can pay in Japanese yen by invoice. Also, some customers have requests for separate invoices for each department, which are complex operations unique to Japanese companies.

Amazon will not accommodate such requests at all, but by going through a reseller like ours, we can properly adjust to such specific corporate needs, so from the customer's perspective it is better to go through our resale service.

In fact, there are two other services besides billing services. One is insurance. Although we have never actually applied this to our company in the past, we have insurance that will compensate customers for damages if a major accident occurs with AWS.

We are also developing another SaaS called "Cloud Automator" in-house, which can be used to automate the operation of "AWS."

For customers, signing up for "AWS" through our company provides various added value and helps you to meet your needs. That's why we have made it possible for you to sign up through Serverworks. This is the second reason.

The third of our main services is the world of maintenance and operation. Because we need to operate 24 hours a day, 365 days a year, we have created an affiliated company called Sky365, a joint venture with TerraSky. This company is located in Sapporo and operates on a 24-hour shift basis. In this way, we provide specialized services to Japanese companies when they want to use "AWS."

The company’s revenue is 90%+ recurring and tied to the value of cloud computing customers use. The remaining ~10% is cloud integration work that increases future recurring revenue. While the large Systems Integrators (SIers) in Japan have AWS engineers and sell the service as well, they also have internal data centers they may prefer to have customers use, which creates potential conflict. Serverworks isn’t constrained by these considerations. Serverworks’ “Cloud Automator” which helps customers track and manage their cloud usage is also unlikely to be pleasant for an SIer to offer. Serverworks show strong customer centricity in this regard.

Competitive Landscape

Serverworks is one of two major AWS resellers that is not affiliated with a large corporation. There was an independent reseller, Iret, that was purchased by KDDI to help KDDI. The other independent competitor is Classmethod, which is focused more on mobile companies, according to Serverworks. The remaining AWS partner level resellers in Japan are all SIers.

The company has a JV that intelligently leverages Fujifilm’s large sales network to reach SMB’s more effectively. This market is not well served by the larger SIers. Serverworks emphasizes clearly that they are investing to grow revenue ahead of profits. The still early nature of DX means that this is a large white space opportunity for the company.

The second topic is that on March 1st, we established a joint venture, Fujifilm Cloud, with Fujifilm Business Innovation. Fujifilm Business Innovation has a very large business in multifunction printers, and has built a very powerful sales network across the country to support the sales and support of multifunction printers.

We will bring cloud-related ideas and businesses to this sales network, thereby enabling us to deliver the power of the cloud to small and medium-sized businesses across the country, known as SMBs.

As I have said, there are reasons for the decline in profits, and above all, we are investing costs that we are confident will result in medium- to long-term returns. We are very positive not only about sales, but also about future profit growth.

All of this is to say that Serverworks has a stronger position in the long tail of Japanese companies. This should be a long term advantage because smaller companies are structurally understaffed in IT departments, if they even have one, and economically disadvantaged in supporting their own IT function in the future given staff shortages. This gives Serverworks a strong advantage in the AWS ecosystem because they are essential to both Amazon and their customers in equal measures. It’s also likely that displacing Serverworks competitively is not cost effective for anyone to attempt since every individual account is not that significant.

Serverworks has seen breakneck growth throughout its entire history. They have ~3,600 accounts across ~2,000 customers, many of which are still in the multiyear growth phase of cloud adoption. Integrating a customer into AWS secures a revenue stream for many years. They’ve had a negligible number of customer losses in their history.

Culture

The company has a very high employee rating on openwork, 4.56, which supports that they are a high quality organization (this is 9th overall out of every company reviewed on the Glassdoor of Japan). This is important because there are ~25x as many AWS job openings as there are people with the skills to fill them. The two major pure-ish play AWS reseller competitors, Classmethod and Iret, have a 4.01 and 3.59 ratings on Openwork.jp, which is also inline with competitors like TIS, KDDI (of which Iret is a subsidiary), etc. (since I started researching Serverworks, the ratings on Classmethod and Iret have increase 0.2-0.3, so maybe it is starting to get gamified). While Classmethod and Iret are private, it is notable that Serverworks management is very vocal about being a high quality employer. This is indicative of a Magic Bakery ™ - everyone has the same recipes, but not everyone cares as much holistically and if you know you know.

The company is aware of how happy employees help to recruit and retain talent, which feeds a flywheel of strong execution for customers that attract additional customers that require additional talent to fully serve. The current labor market in Japan sees a tension between employees traditionally being very loyal and labor shortages driving wages higher to encourage job switching. Serverworks is in a sweet spot where they can obtain employee loyalty and access to the most in demand talent pools. This is a long term benefit for the business as the company can accrue expertise and experience that will continue to help it solve customer problems. An employee driven advantage being prominent in software resale reminds me of CDW, and supports higher than average confidence in the persistence of the future growth rate.

They are explicit about their recruitment philosophy and very explicit this is done with the expectation of getting an economic return:

“As you all know, there is a lot of competition for engineers these days. By recruiting properly now, we believe that it is possible to fully recover the investment in the future, and we can also expect to see long-term employment of high-value-added personnel and a decrease in turnover rates in terms of labor costs.”

Here is the CEO discussing a high profile hire for their GCP reselling subsidiary. It ends with a clear nod to growing rapidly and then focusing on profits once maturity is reached. It demonstrates they know what they are doing, doing so clearly, and doing so with the goal of profits.

Moderator : "I saw the recent release and learned that someone named Yoshikazu Kurosu, who used to work at Google Cloud Japan, has joined G-gen. What specifically will be his role?"

Ooishi : We invited Mr. Kurosu, a former partner of Google Cloud Japan, to be G-gen's CRO (Chief Revenue Officer). He has already taken up his post in October.

Mr. Kurosu is the founder of the Japanese community for Google Cloud, Jagu'e'r, and is quite well-known within the community.

The fact that such a person would be coming to G-gen was a hot topic on social media. I heard that when it was decided that Mr. Kurosu would be participating, his Twitter account (now called "X") got over 1,000 likes. I think that shows how much attention he attracted.

We didn't hire such a high-profile person just to attract attention. We've known him since he was with the company three years ago, and we've always been good friends.

During our various conversations, I also mentioned that G-gen is growing very rapidly. Of course, if you are part of Google, you will understand that G-gen is growing very rapidly.

This growth is solid and substantial. I believe he decided to join us as CRO because he saw that we have great members, a system in place where shareholders are fully supporting us, and a company that is destined to grow.

His role is related to sales, as the name CRO suggests. In particular, G-gen is expected to grow its top line in the same way as Serverworks for a while.

We believe that by expanding our top line, when the market reaches a certain limit and further growth is no longer expected, we can increase the absolute amount of profits by making some changes to our operations and establishing a profit-making structure.

Growth

AWS launched in 2006. AWS Japan opened in 2009. The Tokyo region went live in 2011. There is probably some type of “dog years” conversion factor for AWS Japan to show that it isn’t just 3-5 years behind US or European levels of adoption, as proliferation of cloud applications really took off during the pandemic.

Growth should continue mechanically because they are still increasing the numbers of accounts and accounts steadily increase their spending over time. Given the high growth rate, only 25% of accounts have been with the company for more than 5 years and 50% of accounts of the customers have only been with the company for 2.5 years. Serverworks’ customers currently spend ~$6,500/mo on AWS, which is on the low end of conceivable spending over time (their presentations show ARPU as AWS usage free for the quarter divided by the number of clients for that quarter, page 21 Q3 FY25 presentation referenced here – I divide this figure by 3 for a monthly spend). Given that they focus on smaller customers than the major SIers, Serverworks could also sustain faster growth as they are dealing with low cloud maturity in their customer base compared to large corporates – e.g. double dipping the low penetration nationally and within their market segment.

Using some broader figures around AWS usage indicates the dimensions of the growth potential. This Flexerra survey indicates ~20% of customer use under $50,000/yr (Flexera surveyed over 750 IT professionals and executive leaders on a global basis in late 2023. The majority of respondents were employed by companies with 1,000 to 100,000 employees with 62 percent of respondents headquartered in the U.S). Amongst SMBs Flexerra surveyed, 43% of SMB AWS customers spend under $50,000/mo (the lowest rung of responses possible, which probably tracks closer to the typical Serverworks’ customer). There are many differences, known and unknown to me, that don’t make this apples to apples, but it is broadly indicative of how much higher the spend in Japan could rise, even with just existing customers and now further customer acquisition.

AWS continues to roll out additional application products that run on top of the infrastructure, as well as work on their own AI chips that will likely further expand the scope of their offering. Serverworks can grow from expanding at existing customers, acquiring new customers as cloud adoption expands in Japan, and from the continuing expansion of the AWS product offering. There are many avenues for growth.

Serverworks is a valued AWS partner and from 2023-25 both are investing in advance of expectations of faster growth in coming years. The Strategic Collaboration Agreement (SCA) that they signed in 2023 underpinning these investments has put downward pressure on Serverworks’ operating margins. These largely consist of hiring in advance of cloud demand, since the chicken-and-egg issue at the moment is there isn’t the supply of talent for demand to be activated. This likely starts paying off via sustained high growth and expanding margins in the coming years. It also validates Serverworks as a key partner for AWS even though it is a ~$130m market cap company with $230m of revenue, which is small compared to other companies announcing SCA’s with AWS (Fujitsu, NEC, NTT Data, SCSK, etc.).

Something tells me there is likely to be a multiyear period of increasing cloud usage in Japan as the country plays catch up. At the start of 2024, AWS announced another JPY2.26trn (~$15bn) of investment in Japan through the end of 2027. By contrast, they spent JPY1.51trn (~$10bn) in Japan from 2011-2022. Microsoft announced their own $2.9bn cloud investment in Japan in April 2024. Oracle has committed $8bn over the next 10 years, validating the attractiveness of the Japanese market going forward and AWS’s likelihood of continuing to comfortably retain its relative scale advantage that sustains its competitive position. At the end of 2024, Fujitsu signed a collaboration agreement with AWS and plans to double the number of orders by the end of 2027, a ~24% annual growth rate. NTT Data is investing JPY1.5trn over 4 years from 2023-27 in data centers.

Industry reports on Japan further support the growth opportunity:

IDC Japan predicts that IT spending on IaaS will increase by 21.5% in 2025, while Gartner Japan predicts an increase of 26.3%. Regarding IaaS spending, IDC Japan's Jin Ichimura, Senior Research Manager, believes that small and medium-sized enterprises will continue to feel the limitations of their existing on-premise systems and will continue to move to lift and shift to the cloud. Large companies will accelerate efforts to promote DX (digital transformation), such as adding data integration platforms to the IaaS they are already using. Gartner Japan's Rika Narusawa, Principal Researcher, points out that "many companies are positioning IaaS investment as infrastructure development in anticipation of the use of generative AI (artificial intelligence)."

Total AWS growth for Amazon from 2018-2023 was 28%/yr. While the growth rate declined in 2022 and 2023 from the COVID peak, growth was 19% in 2024. Even though the pandemic accelerated Japanese tech investment, the penetration of IT spend on cloud still dramatically lags Europe and the US, even as cloud adoption still increased in those markets. Gartner estimates that from 2023-28, the number of workloads on the cloud will go from 25% to 70%, which is a global figure.

Over the long term, further growth can be unlocked from expanding the products offered. Serverworks will be in a strong position as they are involved with customers at the infrastructure level. The employee-centric culture gives me confidence that vendors will view Serverworks as a priority relationship. For context, Crayon, while they are primarily a Microsoft reseller, has distribution relationships with Google, AWS, IBM, SAP, Adobe, Red Hat, Symantec, Citrix, etc.

Will this dumb gaijin ever make a buck?

Will the share price ever reflect the underlying value of the business, assuming it realizes some semblance of the potential discussed? There is evidence that the CEO is a dynamic and entrepreneurial leader focused on long term business drivers and not short term accolades or avoidance of inconveniences.

The company has yet to announce a plan related to shareholders, but this isn’t unexpected given the growth orientation. There is still time for this to be released as pressure continues to build for better Japanese corporate governance and the company is likely to be more profitable in the coming years. The company will release a medium term plan in April 2025, which will likely point to the margin expansion discussed and potentially at shareholder returns.

Here is the CEO’s response to a question about the cash rich balance sheet, in January 2025:

Moderator : The question is, "Your cash and deposits have piled up to 7.4 billion yen. Are you considering measures to address the stock price or return value to shareholders?"

Ooishi : The majority of our current cash and deposits are funds raised for business investments, including M&A and recruiting. In other words, the cash is intended to be used for medium- to long-term business growth.

Of course, we are not neglecting returns to shareholders and investors or measures to improve our stock price. We will also work hard on this, but first we will invest heavily in business growth and increase our medium- to long-term corporate value. With this, we hope to reward our shareholders properly, so we hope you will understand.

Is it possible to think about management more broadly? To briefly be an armchair psychologist, a position I am eminently unqualified for because I don’t own an armchair, I believe the CEO is commercial even by American standards. Serverworks began as a business in 2000 and was running a system to share university admission decisions on decision day. This only needed to work for 15 minutes on one day in February with 100% uptime. They had invested in servers, but they weren’t being used most of the year. The CEO stumbled into AWS as a solution to this business problem in 2006/7 and realized it would be impactful and so they pivoted into selling AWS when it was introduced to Japan in 2009. I recount this story because it seems to point to the CEO being observant, in the action itself and as well as awareness of sharing this with shareholders, and forward thinking rather than conservative and preferring to stick to tradition. It is still possible I may be conflating a more ethereal Japanese artisanal instinct to pursue impactful work that will benefit society with a desire to make money by pursuing a money making business.

To provide a more recent example that is strong evidence of a commercial mindset, the collaboration agreement with AWS in 2023 that currently sees margins depressed supports my belief. This requires Serverworks to invest money upfront through its SG&A, which hurts profits in the short term in order to secure long term growth. It is the obvious and simple thing because the easiest and maybe only time to gain new AWS customers is when they initially adopt the cloud. There is a mountain of evidence that customers are sticky and increase spending over time. Because of this decision, lower profitability demoted Serverworks from the Prime section of the Tokyo Stock Exchange to the Standard section. This is less prestigious, and Japanese investors don’t seem fond of it. I suspect that a more traditional management team would view this tradeoff differently – a desire to remain on the Prime section, a desire to report consistent results – and would be wrong for doing so. Below is the full exchange when the CEO is questioned about this and his response is far more direct and properly oriented than the vast majority of American management teams are capable of giving.

Moderator : "This collaboration with AWS is big news and I am very excited about it. On the other hand, I am a little disappointed that we are moving to the standard market. Can we understand that the move to the standard market will mean that there will be more challenges in the future?"

Ooishi: We are not taking on this challenge in order to move to the standard market. Our basic stance will not change - we will continue to take on challenges aimed at achieving sustainable growth in both the prime and standard markets.

However, in response to the question of whether there will be more challenges like SCA, there are not many such large-scale initiatives on this scale. This initiative was reached after close discussions with AWS for nearly a year. I understand that there are not many initiatives of this scale.

However, rather than managing our business while worrying about the standards of the prime market, we have decided that since we are currently clearing the standards of the standard market by a large margin, by stepping firmly on the gas without worrying about the standards, we will be able to aim for greater growth in three or four years' time than if we remained in the prime market as we are now.

Therefore, even after transitioning to the standard market, we intend to continue working to improve our corporate value and further strengthen the trust of our shareholders and investors.

…

If we had not entered into this strategic collaboration, we may have been able to aim for a higher operating profit target for this fiscal year. However, as I have said, the AWS market is still growing, and we have no intention of settling down at a small scale at this time.

Our business model is like that of a SaaS company, but without development. Therefore, we don't take on development risks, so it's a business model that combines the best of SaaS companies.

By capturing the market, we are able to adjust our operating profit margins later, so as long as the market is growing, we should continue to capture it, which we believe will ultimately lead to increased corporate value and returns to shareholders and investors.

We fully anticipated that we would receive some harsh criticism in the short term, but I am confident that three or four years from now, people will look back and say, "It was a good thing we did this at that time.

Lastly, treating employees well is the epitome of simple but not easy things that a business should obviously do. It requires intentional effort and discipline to instill in a company and is not immediately gratifying. While not a guarantee, it increases the odds that the people pursuing this goal do everything else in this fashion as well, which we already see in the willingness to have lower margins in the short term to secure a much larger pool of future business. This dynamic creates the potential for further pleasant surprises over the long term.

Valuation & Earnings Power

There’s a shade under 8m fully diluted shares and the current price is JPY2,500 for a market cap of JPY20bn. Cash and investments of JPY11bn brings the enterprise value down to JPY9bn.

I believe it is reasonable to think about the valuation in terms of normalized earnings power – e.g. how profits would look today if they weren’t investing for growth in both the AWS and GCP business, as well as what margins will look like over 2-5-10 years as the company returns the business to higher margins it already demonstrated prior to investing for growth. In the fullness of time, I assume AWS and GCP reselling have similar margins.

Choose your own adventure with target margins and multiples. My vague guess is Serverworks earns JPY2.2-2.5bn in the next 3-4 years, based on ~6% EBIT margins on JPY57-68bn of revenue after another ~20%/yr revenue growth, which gives room for a deceleration given the near term industry estimate of 21.5-26.3% and the company’s current 32% growth rate. If they grow 30%/yr in the next 2 years, they will already be at the low end of this range. Depending on the growth rate and how much one cares about the cash balance, the enterprise value will approach zero in 4-5 years.

While the revenue growth assumptions are high in a vacuum, they do not seem aggressive relative to the trajectory of AWS, Japan catching up to US cloud spend, or general cloud adoption. In 2019, 2020, and 2021, Serverworks earned a 7.5%, 6.1%, and 5.8% operating margin, respectively, so this isn’t just number plucking irrespective of what margin this business can generate. Note I also cut the net income output by 10%, which implies that the 50% owned GCP cloud business grows to be 20% of the consolidated normalized earnings.

Sanity Check

Classmethod, a strategic AWS partner in Japan, has 8.5% EBIT margins per their own disclosure. They have a broader product offering – Cloudflare, Snowflake, Alteryx, etc – in addition to AWS and GCP, which is possibly an indication that their service handles a more complicated range of tasks and subsequently deserve a higher margin. They have higher revenue, JPY77bn in FY2024, as well. Serverworks describes them as having a greater focus on mobile companies.

Further afield, we can see there are resellers like Crayon, based in Norway, or CDW that print >8% margins. Even Insight Enterprises, which has much larger customers, prints a >5.5% EBITA margin. It is too opaque to confidently plug 8% ebit margins into a model for Serverworks, but it would represent further upside to which I would say, “itadakimasu,” if served.

A specific factor that should mechanically increase margins over time is that the company generates 2x rev per employee for the AWS business compared to its GCP business. This is a visible area where costs are coming in ahead of potential revenues, as the GCP business is younger. G-Gen also merged with a separate Serverworks JV, Topgen, in order to combine Topgen’s cloud integration capabilities with G-Gen’s reseller capabilities, which the company believes will generate cost synergies. Incremental GCP growth is likely to have high incremental margins, as the GCP segment is currently at break even with ~JPY6.5bn in quickly growing annual revenue.

It is also worth pointing out that this is not a capital intensive business. Excluding cash and investments, the company has negative tangible equity. JPY7.4bn of receivables and prepaid expenses are offset by JPY7.3bn of payables, there is no inventory, and little PP&E (Q3 FY25). The company should continue to generate a lot of cash as it grows and depending on your estimates the market cap could be entirely covered by cash in 3-7 years. Net income should convert 100% into free cash flow.

Risks

As goes AWS, so goes Serverworks. Given the early stages of the growth opportunity, channel conflict is unlikely to become the main focus of either party in the next ~5 years, but it is worth being aware of. There is a strong incentive for AWS to pay fairly for the product needs to be sold by a well qualified technical salesforce. This is quite visibly acknowledged by AWS reseller commissions being lower for poached customer than new customers. Serverworks and AWS are still pursuing infrastructure growth in Japan, but eventually the focus will shift more towards cloud applications built on the infrastructure. This should be yet another growth leg for the company that will likely drive focus on continued penetration rather than poaching customers or squeezing resellers. Serverworks is also a leader of the pack of AWS resellers and unlikely to be on the losing end of Amazon seeking to consolidate its distribution.

Numbers will begin to be challenging. Serverworks is one of 2.5 major independent AWS resellers and there are several more within the major Japanese SIers. It’s hard to totally grasp what the true TAM is for them. Crayon, a primarily Scandinavian Microsoft reseller “only” has ~$650m in revenue overall and ~$250m of that in the Nordics. If Serverworks compounds the top line at 15% for the next 10 years, they will be around ~$1,050m in revenue (JPY160bn). The Nordics have a combined population of 28m people, which is ~20% of Japan’s. If mature per capita IT penetration looks similar, it wouldn’t be crazy for Serverworks to hit $1,250m of revenue (e.g. 5x Crayon’s Nordic revenue). This is a very crude calculation of a Microsoft-centric reseller to a pure AWS reseller, although Serverworks still has time to diversify if software offering.

Looking out into the future is difficult. All sorts of technological shifts may alter the cloud market. For the investment to be attractive, one must anticipate a lot of growth. This growth may not come. The growth looks clear for the next ~3 years, but then it’s anyone’s guess. AWS does have a strong market position that they continue to build on, so the momentum of the underlying business that Serverworks resells is still increasing.

Wading into a Japanese microcap has inherent risk. There appears to be a justifiable reward, but this may be taken away in a takeover or other unforeseen changes. NTT is a Serverworks partner and 6% shareholder of the company and may decide to bring the company under its fold well before the full growth potential is realized. TerraSky, a partner and 12% shareholder in Serverworks, also has business partnerships with NTT. Serverworks’ CEO owns 33% of the company, but there may be some cultural nuances that elude a Western interpretation of aligned incentives leading to a takeunder by NTT (prestige of working at a large company, reluctance to take long term risk of wealth tied to the stock market fluctuations, etc). Iret, a formerly independent AWS reseller, was taken over by KDDI, although there may have been other circumstances. All in all, there are factors that are beyond our control, although the CEO has gone the independent route long enough that he likely wants to build a company on his own terms.

Serverworks went public in 2019 and peaked during the pandemic at JPY10,000 from which the shares are now down 75%. Growth has been high and the revenue multiple has dramatically compressed. The market seems uninterested in the investing for growth story and so this remains a mostly revenue driven valuation. The staying power and growth opportunities of AWS are highly visible, which reduces my concern that the growth or profits never materialize. This could still turn out to be the wrong set of assumptions and the market never regains an interest in Serverworks.

Conclusion

Serverworks is an AWS in Japan derivative with an encouraging management team and culture. There is credible evidence the company is investing for growth and the normalized margins are much higher than currently reported. Taking a longer term view points to higher margins on much higher revenue, which should translate into higher EPS.

Maaku out.

Very compelling read

Andy, this is incredible. I’ll have to pick your brains regarding some JP small caps I’m seeing on my end.