OpenjobMetis (OJM)

Two great pleasures in life are mortadella and cheap stocks, and Italy has plenty of both. OpenjobMetis is a Milan listed staffing company focused on small Italian businesses. Temporary staffing continues to gain intentional legal clarity and customer adoption in the Italian labor market. This presents a structural tailwind in the medium term towards higher penetration of temporary labor as portion of the total workforce, which currently lags other developed European countries. OJM has the opportunity to grow organically on the back of this shift as well as a proven ability to acquire smaller operators in a cost effective manner. This also makes OJM an increasingly attractive acquisition target, as a larger player won’t have the same bandwidth as OJM to roll up the smallest players. The company’s high inside ownership, consistent share repurchases, and prudent balance sheet position it well over long term in spite of present issues in Europe and Italy’s economies that make the stock out of favor.

Business

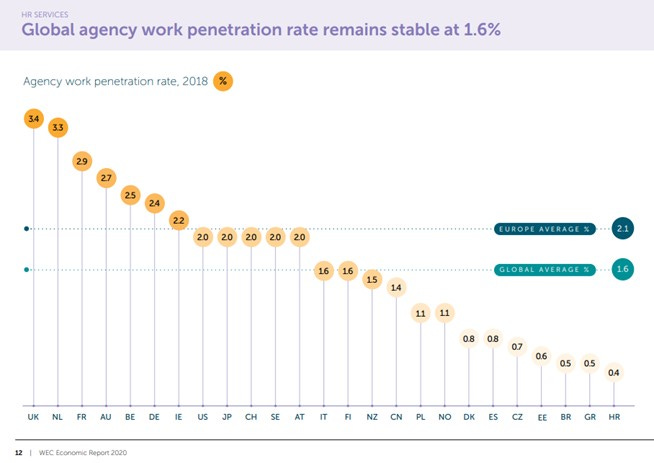

The Italian temporary staffing industry was only created in the 1990s. It has gained more clarity over the years, with the biggest jump happening in 2014 with the Italian Jobs Act (read this paper for more details or this one). Some limitations were reintroduced in 2018. Italy was in recession in 2019, then some stuff happened in 2020 and 2021 that makes it hard to definitively say the 2018 reforms weren’t an issue, but 2021 revenue was well above 2018 levels. I’m not an expert in labor law, but temporary labor is about 1.6% of the Italian workforce compared to 2.1% on average in Europe. Labor market reforms in Italy have been an ongoing tussle since the 1990s, but the general direction has been one of increasing acceptance. While a derivative on Italian GDP is not that compelling, this more idiosyncratic undercurrent provides some insulation from the broader economic drivers in Italy.

The top 6 players control about 2/3 of the Italian market, with a tail of another 45-50 players. OJM faces 3 very large global players in Adecco, Manpower, and Randstad, a large international player in GI Group, and a comparable domestic peer in Umana. OJM organic growth does not always keep up with the larger players, but I believe this is representative of their customer bases.

OJM differs itself from the larger staffing companies by focusing on small and medium sized businesses instead of larger corporate customers. OJM can be more valuable to these customers, who often lack a large HR department and are only hiring 1-2 temps. The top 10 customers are <10% of revenue, so there is a long tail of fragmented customers they serve. While this approach requires a more intense salesforce effort than a large staffing agency signing a framework agreement with a large customer, it also makes it more difficult for new competitors to quickly scale. OJM also avoids staffing services for public/government jobs, which I view favorably as there are always complications to this customer base even if it can provide a short term boost to revenue.

OJM does not generate a lot of revenue from permanent placement, whereas larger players such as Adecco or Randstad do, which supports higher EBITA margins at competitors. The larger players also have greater scale in general.

The staffing business model is working capital intensive, but requires little in the way of PP&E. Net income divided by net working capital and PP&E averaged 24% from 2017-2019. It has been 24% and 21% in 2020 and 2021, respectively, which is still good. The net income return on invested capital, which includes intangibles from acquisitions, is 10%. In 2020 and 2021, it was 7%. On a TTM basis to 9/30/22, it is back to 10%. This is not glorious, but it should increase as they lap acquisitions and COVID disruptions. The larger players don’t disclose country specific returns for comparison, but they generated ~50% net income returns on tangible capital and ~20% net income returns on invested capital in the same time periods, which is better than OJM (it’s unclear how much of the delta is impacted by geographic exposure and permanent placement profits versus scale).

What’s this thing worth?

At EUR8.30/share with 13.35m shares outstanding, the market cap is EUR111m. Net debt is EUR12.7m, so enterprise value is 124m. Trailing twelve months EBITDA is EUR28m, net income is 13m, an 11%ish earnings yield and 4.5x EBITDA.

If they can earn ~EUR15m of net income, that is a 13.6% yield, which should be possible when they get all the savings from a large acquisition they completed in early 2021. If OJM gets acquired for 8x current EUR28m of EBITDA in a few years, that’s a double, not including dividends, reductions in the share count, or earnings growth, which would push this from a mid to a high teens return. While 8x is ambitious, even 6x would be a double digit return if it happens in the next 5 years. This also implicitly anticipates a scenario where there is no growth or a dip and recovery in the next 5 years.

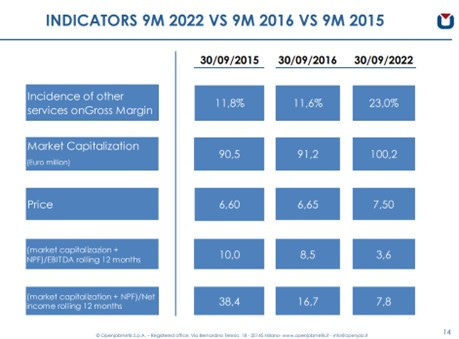

This company is hard to accurately model in any given year because margins are thin and small variations in any line item can fat finger the outputs – these numbers are impressionistic and a more precise model would likely only further bolster that the shares are cheap. The first 9m of 2022 saw EBITDA of EUR22.9m, EBITA of 17.9m, and net income of EUR11.4m, which annualizes to EUR30m, EUR23.9m, and EUR15m, respectively so the company seems to be effectively capturing a lot of the cost savings from the deal.

OJM is in a good position to make attractive acquisitions, which it has done several times in the past, most recently with Quanta in January 2021. There are lots of redundant costs in maintaining branches in the same geographies and at the corporate level. There is industrial logic and a market clearing price for OJM to get bought eventually. It’s also worth pointing out that a EUR100m check is much more intriguing for a large corporate player to write than several checks that cumulatively add up to the same amount. This dynamic puts hard to quantify but still valuable upwards pressure on the value of OJM.

Depending on the pace of recovery, the combined 2019 EBITDA of OJM and Quanta is already EUR24.3m, which they are currently exceeding, and synergies could see OJM generating EUR29.3-30.3m in EBITDA in the next 2-3 years, which they are already clos to and should translate into EUR15m of net income.

One of OJM’s Italian competitors, Obiettivo Lavoro, was purchased for EUR102m by Randstaad in 2016. Randstaad described the acquisition as “opportunistic” on conference calls, which I interpret as “the price was right.” Obiettivo Lavoro’s 2015 revenue was EUR436m and EBITDA was EUR20m. This 5x EBITDA multiple compares favorably to OJM’s ~4.5x 2022 EBITDA. Even in a “takeunder” situation, which I consider unlikely, that represents 10% upside from current prices. While I would normally consider this an upside cap, there are long time insider shareholders of OJM who are unlikely to be “opportunistically” acquired and their balance sheet is unlikely to put them in that position. This is much lower than the 8x average EBITDA multiple from a cherrypicked dataset OJM offers, which obviously implies significant upside. The .23x revenue multiple for OL was also higher than the ~.15x 2022 revenue OJM for which currently trades. I think this presentation slide can be viewed twofold – both as the M&A value creation opportunity for the company if it remains independent, as well as broadcasting the price they might be willing to accept from an acquirer.

The shares are not very liquid, but the company has been a regular purchaser of its own stock. Trading volume makes it difficult to repurchase in size, but it does provide some insight into the Board’s opinion on the valuation. They company recently became more aggressive with their buyback, offering to buy ~2% of the shares at EUR8.80, a more forceful expression of their opinion than buying EUR10k worth of shares every week for months. The company is getting quite explicit that the share price is cheap. This stance and activity is a strong signal that the stock is interesting.

There is a high inside ownership at the company distributed over several different players. Through MTI Investimenti, the CEO, who is also the founder, owns 3%, HR director 1%, and Commercial Director 1%. The Chairman and a Director collectively own 17.8% through Omniafin. The Omniafin holding came through OJM acquiring Omniafin’s staffing company, which I view as a positive indication that the largest shareholder is not that interested in running a staffing company and willing to sell things for the right price. This is speculative on my part, but that they merged an entity into OJM that they still largely controlled reflects better on their capital allocation shrewdness over the long term than the CEO/founder of OJM, who owns considerably less (this is just a hunch - there have may have been different starting circumstances beyond his control and Omniafin may have been more risk seeking by using more debt). The seller of Quanta now owns ~4%. This is a good balance and alignment with outside shareholders. I take comfort in there being multiple parties who appear to be economic animals with real ownership stakes. Sensible decisions have been made to date under their collective management – both capital returns and acquisitions – and I suspect OJM will accept the right bid at the right time.

Risks

The most obvious source of hesitation is that this is a smaller player in the staffing market, which itself is already not a phenomenal industry. It is economically sensitive, consumes working capital to grow, and operates on thin margins. The after-tax all in ROIC of the business is average. This becomes even more of an issue during times of high inflation, as the business requires working capital investments proportionate to the revenue, which sucks in capital. The return on tangible capital is 25%, which is an alright position to be in during inflation, but is obviously not as good as not requiring any incremental capital to respond to higher nominal prices.

The big risk at the moment is Italy imploding on rising interest rates, high energy prices, and a broad European economic collapse. While I think that is a bit of a doomsday scenario, this can specifically put lots of pressure on OJM’s customer base, to which OJM is also extending credit in the form of payroll. As in life, OJM’s greatest strength is also its greatest weakness – focusing on SME customers. These are the companies in the worst position to handle a skyrocketing energy bill or a sharp downturn in revenue. Eight months into the war in Ukraine, industrial production and GDP has not collapsed, so it is still doomsday deferred. It remains to be seen what happens as the Eurozone starts to raise rates to combat inflation.

As with any company where there are controlling shareholders, there is the risk of a take under. I do not know what problem this solves though, because in selling their businesses, several board members are revealing they are looking to get liquidity for their stakes. Especially given the business model’s consumption of working capital to grow, I don’t think they have taken a lot of cash out of the business over the years that is waiting on the sidelines. They could all play the game of buying it in its entirety today for a cheap price and selling it in the next upcycle. The risk for them, assuming I am correct they don’t have a lot of liquid assets outside the shares in OJM, is that they would have to finance the takeover with debt, which would be risky with the economic outlook and the sensitivity of the business model.

At the broader level, the big risk seems to be that the Italian economy is a tough place to operate even when times are good, which can put a damper on growth. The company went public at the end of 2015 and had good revenue growth in 2016-2018, but stalled in 2019. Italian labor laws continue to seek a balance around opening up to temporary workers and reforms stalling. The economy was technically in recession starting in Q4 2019. Beyond the direct impact of COVID, the rock and hard place of austerity and high debt/GDP has only become rockier and harder in the aftermath, which is unlikely to make decisions easier for legislators to make around labor laws. At the same time, that it is a difficult place to operate makes the relative attractiveness of using temporary employees for a company that much greater, because it gives flexibility to meet demand they may otherwise just not fulfill because they don’t want to permanently increase capacity into a recession.

The perceived low penetration rate of temporary labor may be a fallacy of composition. This reveals how little I know about the legal system for Italian temporary labor, which is a clear risk. The north of Italy is economically close to par with Germany or the Netherlands, while the south of Italy lags. It is possible that a more granular data set would reveal that the north of Italy, where OJM is already well established, more closely matches the penetration of temporary labor already seen in other European countries. To an extent the penetration rate is dependent on the legal climate, not a high GDP per capita, as Norway or Denmark demonstrate with their lower rate of temporary labor. It may be perfectly reasonable that Italy’s labor market resembles Italy’s labor market and there’s no intrinsic reason for it to resemble France more closely than Spain.

In January 2021, OJM acquired Quanta. Quanta has received a “questionnaire from the Italian Tax Authorities” around VAT treatment in 2015-2017. While I interpret these circumstances slightly favorably, the risk of getting involved in lengthy litigation with the seller and angering the Italian tax authorities exists. Quanta got a bill from the Italian government on in November 2020 for EUR592k, which is currently under appeal. The seller of Quanta gave OJM a specific guarantee to cover any liability from the VAT treatment and there is already EUR1m in escrow. OJM has also received an inquiry and wasn’t given a bill, so they presumably know what the correct procedure looks like. The trade association for staffing agencies has gotten involved for common defense and clarification, which reduces the likelihood this is a Quanta specific weakness. That OJM knew this about Quanta before purchase, the escrowed amount is higher than the current bill, and OJM not receiving a bill supports an interpretation that this is not a risk that could metastasize. There is also inside ownership at the board level, so I give good odds to them not being rushed into a deal to stroke a CEO’s ego. It is still something to monitor.

Lastly this may just be an overly cute and dumb idea. The inside ownership, acquisitions, and buybacks are an attractive proposition at ~8x earnings and a potential windfall from acquiring things cheaply or being acquired dearly. That said, Manpower, Randstad and Adecco trade for 9-12x 2022E earnings, have large dividends, and have higher returns on tangible capital. Their exposure to the staffing market is more diversified, which dilutes Italy specific risk, but at an abstract level offers the same “exposure.” I think what changes the calculus for me is that there is a greater likelihood for “value creation” from OJM in the form of needle moving acquisitions that are still very cheap and its eventual acquisition by a larger company. The global players, in my understanding, offer GDP type growth and don’t have the same needle moving capital allocation opportunities. I don’t think I am making the mistake I am alluding too, but this will serve as reference if that happens to be the case.

Conclusion

This is not the most captivating idea in the world. This is a cheap company with low leverage and an owner oriented management team and board that is signaling the shares are undervalued. They are ramping up the buyback, have a meaningful dividend payout, and point to the valuation disparity both relative to M&A and its historical valuation. The macro environment is not great, but that is also how the shares have gotten so cheap.