C Uyemura is interesting in the context of a cheap Japanese company, a shift to being more shareholder friendly, a conservative balance sheet, a high quality business, and a growth runway on the back of secular trends of digitization/electrification of more of the economy.

Business

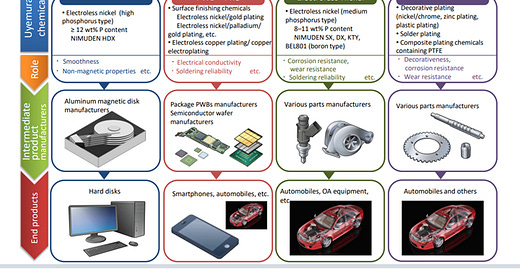

C Uyemura produces chemical mixtures used in the production processes of electronics and industrial components that improves their end use performance.

I have a long running interest in businesses that mix commodity chemicals into proprietary recipes that serve a valuable function that’s a small part of the customer’s costs. These tend to lead to persistent earnings, low capital intensity, and lots of distributable cash flow. Recipes are typically developed in close cooperation with customers, who are unlikely to waste their time with new entrants who lack experience or broad product catalogs, which creates a nice barrier for incumbents. C Uyemura is also an expert at the application of these recipes to the customers products, sometimes performing the task for them directly or selling customers application equipment. This not only creates stable relationships with customers, it means customers are unlikely to just go find a generic chemical blender to copy a recipe and be able to get on fine without Uyemura.

These recipes require a bunch of different chemicals which a company like C Uyemura doesn’t produce and only mixes in batches, a relatively uncomplicated production process that doesn’t require expensive high fixed cost equipment. Customers, who are producing semiconductors or metal and plastic components, essentially send C Uyemura a check for every unit they produce as consumption will scale with unit production. The mixtures are a small portion of production costs but mission critical to performance. This is nicely compounded by the fact that the components C Uyemura helps produce are not a large portion of an end product’s total cost either. The mixtures are put through testing and certification processes by customers that then use them in a production process for around 5 years, so there’s nuisance from many angles when it comes to switching.

C Uyemura has two US listed peers in the form of Element Solutions (ESI) and Atotech (ATC), which means there is a lot more information about the underlying business in the public realm than one would believe just from the C Uyemura annual and investor info. One thing that stands out is that Uyemura’s margins are still in the same ballpark as larger Western peers. This hints at the quality of the industry overall and Uyemura not being oblivious to the underlying earnings power their position should command and not squandering it unrelated business lines.

If you would rather not listen to me with my abstractions, here is the Element Solutions CEO at the 2018 Analyst Day basically saying the same things alongside some other nuggets that matter to me:

We bill our customers for products, but what we're selling is technology and service. Our products themselves are manufactured in relatively simple formulation-based processes. So the asset intensity, the capital intensity of this business is quite modest. What the customers are buying is quality, reliability, technology, know-how and service that translate into better outcomes for them and for the products that they're manufacturing towards.

Our innovation team is innovating on existing products that they've developed. It's incremental development. Our customers rely on our technical

service people. These are people with names and faces that show up at their facilities every day and ensure their manufacturing processes go well. Not only is the chemistry important, but having expertise in how the equipment operates with the chemistry is also extremely important and our customers rely on us to understand how all these things interact.

And finally, all of these products I've listed share some common attributes. They're differentiated, they're difficult to commoditize and they require extensive applications expertise. And all of these attributes produce the high margins that we continually strive for.

So what sets us apart from other suppliers in this market space? First, we have a deep bench of chemical specialists who provide on-site expertise to our customers, which is in keeping with what we call our high touch business model. Circuit boards are increasingly complex, building them requires essentially an ecosystem of experts. Ours are well positioned globally. They all speak the local language and they're all connected to a system of continuous training. Our moat here is comprised of our employees, applications and technical service expertise, which takes years to develop. We also believe we have best-in-class technology solutions, focused around high-value, leading-edge market opportunities. This is the consequence of innovation driven by the specific needs of our customers and by the technology trends that we see in today's market.

You're going to see the similarity in the business model and the structure. So we produce -- we formulate and produce chemical additives that are used to treat surfaces, both metallic and nonmetallic. We serve almost every kind of manufacturing industry in the world. The most important industry we serve and the largest end-use market is the automotive industry, and that -- we are engaged in the automotive industry everywhere in the world. We -- our finishes, as you can see here, provide anti-corrosion coatings to prevent rust and degradation; decoratives, the most famous of which, I think is, what we would all call chrome on a car or a faucet; wear-resistant coatings, clearly used in all kinds of equipment, including automotive. For films, very soft plastic film that's used throughout industry, including in automotive, we treat with chemicals that produce a hard coating to resist wear and also resist chemical corrosion and degradation for the life cycle and length of a vehicle, in particular. And then finally, with the advent of the new technology cars and the demand for lighter weight, steel is being replaced by lighter metals, particularly aluminum.

And that offers us a tremendous opportunity for new treatments, new surface treatments for both performance and longevity. And this, again, is very much part of the automotive industry.

All right, what sets us apart? Well, first of all, we have a very deep and broad engagement with the automotive OEMs and Tier 1s throughout the global supply chain. This has allowed us to participate in the development of specifications and development of applications and a know-how -- a deep know-how for the needs, meeting the needs of the automotive industry. The automotive industry is attractive because it's a very high-spec, high-value market for us and the technology that we create in the automotive industry is then used throughout other manufacturing industries.

We also have a global base of leading applicators, those are our direct customers. These are people that are part of the supply chain, industrial supply chain around the world. Like in the Electronics business, our applicators use our chemical processes and meet the needs and specifications of the automotive industry and other industries all over the world. We are the market leader in our space. We are particularly involved today in developing technologies for the new technology vehicles, so meeting needs that we understand for the future as we work with the car companies.

And there is an ever -- an ongoing and ever-increasing demand for environmental and sustainable solutions to problems. The elimination of materials of high concern, the elimination of metals that cause problems for people and the environment, all of this represents great opportunities for us.

In 2018, our cost of goods sold was about $1.1 billion. 80% of that is made up of materials, 50% of that was nonmetals and 30% of that was metals. This whole spend is all flexible to demand. On CapEx, in the middle of the slide, you can see that we've spent meaningfully less than 2% of sales over the last couple of years and we expect that trend to continue. See, our CapEx spend is not on expensive equipment for our production facilities, it's primarily on MRO; environmental, health and safety investments; and growth investments related to our applications labs and our technical service labs.

Element Solutions has a relatively lean operating footprint. And you can see here that we spend a majority of our OpEx on selling and marketing expense. This should not be surprising to any of you, given what you've heard today about our close customer relationships, the local selling and technical service we provide, and it's an important part of the moat around our business. It's also important to note, though, that we view more than half of our SG&A to be fixed to a new dollar of sales.

The business has some patents, but a lot of it is trade secrets, and we protect it in multiple different ways. So first of all, we formulate ourselves. Second of all, when we have really important trade secret technology and products, we'll send coded raws into the field for formulation. So the -- we'll send a concentrate of the product without disclosing what that product is, and the manufacturing team will know to put X parts of Product A and Y parts of Product B to formulate the product. So they won't actually know the specific formulation. Furthermore, as Scot took you through that example of how we deliver a solution as opposed to simply a product, there are multiple different steps to deliver any specific outcome, and each of those products is essential to the process and very, very few people actually know what's in each of those different steps. So simply understanding what's in one of the steps doesn't get you to the same outcome.

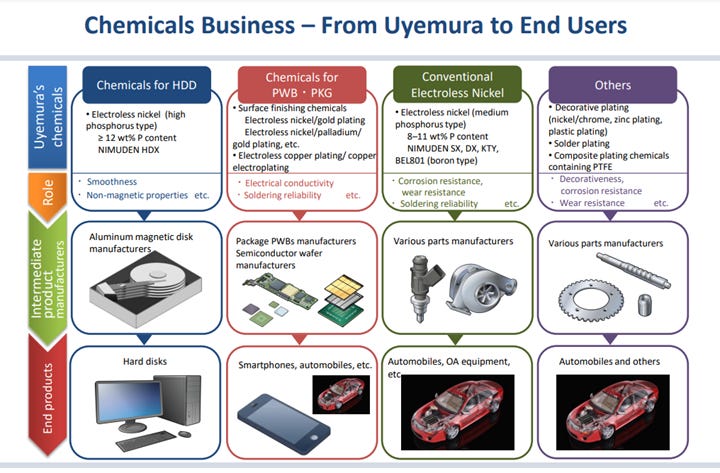

Uyemura only gets 40% of revenue from Japan, so they have proven they can operate outside Japan. Revenue breakdown is 18% from Taiwan, 13% from China, and the remaining 29% elsewhere. The Atotech prospectus shows that this revenue by geography does not capture revenue by end user demand, shown below, which likely applies to Uyemura as well.

Atotech shows examples of what components are produced in part with these recipes. These seem evergreen in nature – i.e. they are fundamental to the products. This breadth of applications reduces the risk of technological shifts undermining the need for Uyemura’s products.

Growth

Uyemura have growth ambitions with a JPY30bn investment plan over the next 3 years. According to Atotech’s prospectus, both the semiconductor and the industrial sides of the industry have nice tailwinds to growth, outlined below. While the semiconductor market is on fire, and PCB’s have tagged along for the ride, the medium term opportunity is a combination of diverse secular trends. While a prospectus is naturally optimistic, I don’t see any of these market drivers as being faddish. The song remains the same across the industry and the end markets that they are claiming face these trends.

Uyemura appears to be successfully playing alongside their larger peers on the basis of achieving higher growth in most years. I suspect this is driven more by product mix – Uyemura seems to be weighted more towards chemicals for PCBs than plastic or metal industrial surface applications – than anything else.

Some things to note about the above - I calendarized results and put in USD this info through Sentieo to get a comparable view. As stated above, there are cost escalators for the raw materials, which comprise 80% of COGS, which means gross margin is probably a purer representation of absolute growth. That said, for comparability sakes, all three companies face this dynamic, so revenue is fine for a relative growth comparison. A gross margin comparison would introduce a different type of noise since Uyemura and Atotech sell more equipment and provide more application services, which have a different margin profile, than Element. This activity is also part of the whole package that drives the business, which makes disaggregating it misleading. So I think revenue is the least imperfect metric available for comparison.

Valuation

The valuation is straightforwardly cheap on all metrics. The FY22 (3/31/22) forecast JPY8.4bn of net income and EPS of JPY475 as of November 2021.

Relative valuation further highlights C Uyemura’s undervaluation. MKS Instruments is acquiring Atotech for 5.4x EV/Revenue and 13.5x EBITDA ($1.2bn revenue, $480m 2019 EBITDA, $5.1bn equity, $6.5bn EV. ESI trades for ~3x revenue and ~13.5x EBITDA. In June 2021, Element announced the acquisition of Coventya for EUR420, for a business with EUR160m in revenue and EUR 30m in EBITDA in FY21 (ended Sept 30), although they expect EUR42m in proforma EBITDA, which works out to 2.6x revenue and 14x EBITDA/10x post synergies. A 13.5x EV/EBITDA multiple for C Uyemura would be ~2x from current prices excluding any credit for the cash or investments or buybacks.

“Catalysts”

The newly announced repurchase plan and higher dividend payout are translating into meaningful capital returns on top of a favorable backdrop for the underlying business, so I am not too hung up on hand waving over broader Japanese corporate behavior or that one could also find plenty of other cheap Japanese stocks. Meaningful amount of the profits are being returned to shareholders.

From 3/31-6/30/21 the company repurchased 2% of shares (they even trumpeted it in English) and has a plan to repurchase ~JPY2bn annually from 2022-24, another 6% of the current market cap. They repurchased 5.5% of shares over FY11-21, so the concept isn’t completely foreign to them, but the quantum appears to be increasing dramatically going forward, as this amounts to ~35% of net income on top of dividend payout amounting to ~25% of net income. There is at least one Japan activist fund involved that reports spending a lot of time with management. This likely plays some role in the recent announcements.

The company canceled the c-suite retirement plans and instituted a share linked compensation scheme, which seems like a nice way to get them to be aware of the share price and valuation. If these moves to be more capital efficient mean their capital allocation shouldn’t be dinged for their cash rich balance sheet, this looks more like a 16% after tax return on net assets business that is worth a lot more than it currently trades for. They do state they may use shares in acquisitions, which is a risk if they just recycle the cheap shares on something more expensive. They also have the cash on hand to buy whatever they want with their JPY10bn M&A budget over the next 3 years, so it’s hard to tell what the future holds in this regard.

Conclusion

This is a good business that is not a lumbering dinosaur. The end markets are attractive, cash generation is inherent to the business, and the product is a low cost mission critical input to products of which the world is increasing its consumption. The company is cheap on an absolute basis and relative to peers. There is at least one activist involved already successfully nudging the company in a more shareholder friendly direction.