This is a dumb sounding idea, so I decided to write down my thoughts to see if it reads dumb too. Ashford Hospitality Trust (AHT) is a business and stock at point of maximum pessimism. Operating leverage, financial leverage, dividend-less REIT, and impending dilution from preferred conversion. This has interesting option value because there is a non zero probability each of these factors, which basically couldn’t get any worse, reverse in some measure. The leverage on leverage at the business level combined with the leverage on leverage at the technical share level make for a lot of leverage. Leverage works both ways and we’ve already seen how it works on the way down.

The key point of distinction for Ashford is that all of the debt is at the property level. Many of the hotels can be worthless and turned over to lenders, but the remaining hotels will still give value to the equity. Most options expire worthless, as this very well may, and the leverage makes the residual value for equity very sensitive, so this isn’t for the faint of heart.

The trend in hotel occupancy points to both an extending runway from a cash burn perspective and the likelihood that some asset sales might occur at reasonable enough valuations in the coming months to support the remainder of the assets through the downturn. Asset values could receive a positive offset from interest rates being lower, but won’t totally offset the hit from COVID and negativity around hospitality. It is important to think of proceeds from asset sales to in the context in which their sale will occur, which will be months, if not a year, out due to the cash on the balance sheet and pockets of assets reaching break even if not positive territory. Management may also find ways to raise additional cash to survive until the industry recovers that don’t involve selling assets.

Background: Gee golly the chickens have come home to roost for the Ashford complex. Ashford Hospitality (“Ashford”) is in essence a financial product assembled by Ashford Inc (“AINC”) for the benefit of AINC. It generates fees for AINC and provides “value” to customers who want an optically high dividend yield. These customers are unlikely to have yachts.

Ashford has been run with a high debt load relative to anyone else because it meant more assets could be bought and fees upstreamed to AINC. Against $425m in adjusted 2019 EBITDA, the company went into COVID with $4.1bn of debt and $565m of preferred shares, which is already 11x 2019 EBITDA. Pretty wild for an entity with no contractual cash flow.

Ashford and AINC’s business has unwound in recent months as COVID hit the operating results of the hotels, the financial leverage became an issue, the dividend was cut and retail shareholders sold, and now the management team is trying to exchange the preferred equity into common equity and massively dilute the existing equity.

The people who want to own this, let alone even care to look, let alone can, are minimal – size, management quality, leverage, industry, high risk of appearing stupid, and macro preclude interest in many different dimensions. So I guess that leaves schmucks like me.

Payoffs: The payoff is unknown and uncertain with a real chance of zero. This makes me think it is mispriced to an overly pessimistic degree.

There are probabilistically favorable factors to consider. The debt is entirely property specific. The corporate entity has no debt. The worst assets from a cash flow and leverage perspective will likely be returned the fastest. Debt levels and cash burns will decrease when the worst hotels are returned to lenders. This means that even though the quantity of hotels in the portfolio decreases, their average quality increases and the probability of residual value for the equity surviving increases.

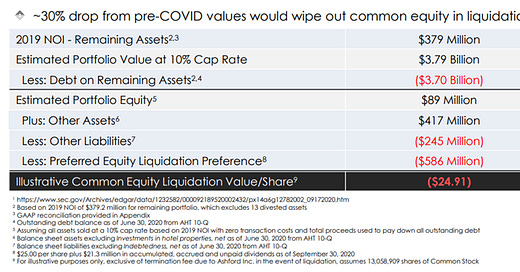

The reason to suspect this presumed path unfolds is because of greed. Ashford Hospitality pays a lot of fees to AINC. The last thing AINC wants is the fees to disappear. The quickest way to make them disappear is for the entire Ashford portfolio to be taken over by lenders who can then find other managers. The individual hotels are not just a fee generator for AINC, but the Ashford entity overall generates fees for AINC as well at the G&A level. The incentive - and AINC demonstrate an inclination towards money without consideration of appearances – is to retain as many of the hotels as possible. Even this fear inducing presentation, below, from the company in September shows a $11 of value for the preferreds (link). If the company actually returns more hotels to the banks, there is a chance value to equity increases as the “Other Assets,” which includes cash decrease at a much slower rate at the trough of occupancy and higher debt properties are jettisoned first.

This, from management assumes a 10% cap rate, a trough distressed cap rate if they had to sell all the properties today (spoiler: they don’t). Any type of normalization that may occur if a recovery becomes more apparent would see the cap rate move down. Every 10 bps improvement in the cap rate is worth $40m of value that cascades to the prefs and common, compared to a currently implied value of ~$110m (market cap plus total market value of the prefs).

Even if NOI decreases due to returning hotels, debt will shrink fairly proportionately. The fulcrum NOI is around $200m. At a 10% cap rate that is worth $2bn and at 8% $2.5bn, which would almost cover the preferreds, assuming debt/NOI is ~10x. As long as they retain more than ~$200m of NOI the prefs will be worth more than current pricing indicates by a wide margin. So they could still return close to half their current portfolio to lenders without really impairing the prefs.

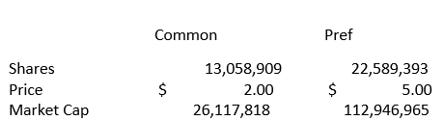

There are scenarios that can play out where the prefs are worth par and pay deferred dividends and where the common is 3-24x+ from here. The prefs could get back closer to par without being impaired too badly by whatever steps are taken between now and a full recovery. The common has a rockier path, which potentially involves dilution or total loss. Upside is based on $2/share for the equity and $5/pref share.

There is a saying, of which I am quite fond, about highly levered situations that if you like the debt you’ll love the equity. My position is a small one and 6 parts pref and 1 part common. There will be things that occur in the coming months that will shuffle around some of the value, such as a high yield issuance ahead of pref and common equity, to help keep management in control. I don’t know when and and on what terms they will occur, but it’s something to keep monitoring.

Assets: The company currently owns 104 hotels after giving 13 hotels to lenders over the summer. The hotels are mostly full service with above industry average RevPAR. Properties are spread across the country, but weighted to major metro areas – 38% suburban, 35% urban, 16% airport, 8% resort, 3% small metro, <1% interstate. Group bookings in 2019 accounted for ~20% of occupancy, so they are not overly reliant on a type of travel that is done for the foreseeable future, but there is still a very material business travel component to their mix. There’s not a strong unifying theme or iconic assets to hang one’s hat on.

I am making a broad assumption the Ashford portfolio occupancy mimics the national behavior. I am also assuming there is no property that looks like the average, but is either struggling with low occupancy or is close to, if not already, profitability. A challenge with the disclosure is that there is not an abundance property level information, which makes it hard to identify pockets of value that either could be sold to elongate the company’s runway into a recovery or be the remaining core of quality if the company jingle mails the junk. There’s no historical property level EBITDA or occupancy that can be matched up to property level debt, which is also cross collateralized in some cases. There are about ~30 different mortgage pools, so the dynamic where poor performance in a few assets doesn’t take down the whole company stands.

Given the geographic diversity, I am making an assumption they are doing better in some regions (FL, TX, AZ, etc) than others (CA, NY, etc). Even post labor day, national occupancy has been holding up in the high 40’s, which is not optimal, but not the devastating levels of March or April (link).

Cash Burn: At of 6/30/20 they have cash of $165m and $95m of restricted cash. The restricted cash is at the property level and can be used to fund property expenses, so it seems reasonable to treat it as applicable in the cash burn runway for the company. This totals $260m of cash, which is a little under 3 quarters of trough cash burn, which would take us to March 30, 2021. There are puts and takes as to what the actual go forward cash burn will look like.

On their Q1 conference call, May 21st, they cited current $20m/month of cash burn and $13m of interest expenses. Weirdly this wasn’t discussed on the Q2 call on July 30th, but occupancy was higher in Q2 than May so cash burn in Q3 may be lower. The May figure also includes 13 hotels that have subsequently been returned to lenders, despite the company having cash on hand to service the debt, which makes it probable they were relatively high cash burn properties. They have not updated cash burn, but they are not stupid. I don’t believe they returned hotels without careful thought around cash burn, equity value, and speed of recovery specifically because they do have the cash on hand requiring them to make these cost/benefit decisions. As an example, the largest hotel they returned was an Embassy Suites Time Square, which requires Simone Biles level of mental gymnastics to envision not having high per room cash burn and a very long recovery period.

It’s difficult to extrapolate the summer season cash flow into fall. The customer mix shifts from leisure in the summer to business in the fall, but this won’t happen this year and occupancy may drift back down to negative cash flow territory. So maybe the $20m/month figure is close enough to carry out through the rest of the year, but this may be overly pessimistic.

The hotels will burn another ~$120m by the end of the year from 6/30/20. There’s another $13m per month interest expenses, likely closer to $12m to account for hotels returned to lenders. The interest payable accrual could potentially get tacked on to the principal and not need to be at the end of the forbearance period, which would give more breathing room. The current forbearance agreements have interest repayment starting at various points from September 2020 to January 2021, but the company has the cash to handle this. Loan modification structure is something to monitor both at the company and industry level.

The “potential operating shortfalls,” from this September presentation, hints at my suspicion the hotels are in a better cash flow position that they want to imply, since it could have been positive for certain summer months. The debt service is fluid as they have 61% of their debt is in forbearance (link).

Valuations: The cash burn, continuing at current rates, becomes an issue at the start of 2021 if it continues at the 6/30/20 rate. While this is a shorter time frame than my preference, its worth noting there is a chance a COVID vaccine is front page news and the forward outlook in January is more positive than it is today, opening up a whole range of fundraising options. This might allow some properties to be sold with positive equity between now and whenever they might run out of cash based on projections using 6/30/20 figures.

A lot of the current market value hinges on the assumption that valuations for hotels will be at a massive discount to 2019 levels, but there will not be a fundamentally different view on the earnings power of a hotel. This is where a wide range of outcomes comes into play. On 10/1/20, a Residence Inn in Boston sold for a 7.8% cap rate on 2019 earnings (link). That one is in Cambridge. Ashford owns a Hilton with $97m of debt on it in the Back Bay part of Boston. That Xenia hotel currently has a nightly rate of ~$161 vs ~$158 for the Ashford property, although former is in the middle of MIT/biotechland and latter next to Fenway and Northeastern University. Assuming 10x debt/NOI for the Ashford property implies $9.7m of NOI. This has no residual value at a 10% cap rate, but $27m of equity at an 7.8% cap rate. It’s not productive to obsess over precise cap rates, just the direction, if any, they head in from 10%, because it creates the opportunity for Ashford to dynamically respond to whatever situation unfolds.

Pensions and other institutions are starved for yield and interest rates are low such that there could be buyer interest in these assets if they start to stabilize. If hotel pricing goes down 20%, that implies cap rates moving from around ~8% to ~10% for full-service hotels, which is most of Ashford’s portfolio. At the end of 2019, people were interested in 7.5% cap rates and the interest rate outlook is biased towards lower rates. This is a PWC real estate investor survey on the desired rates of return on hotel deals (link):

A longer term view of hotel cap rates shows that even in 2009, hotel cap rates peaked at 10% for all hotels and full service hotels peaked at 9.5% (link).

Ashford alluded to there being some hotels they could turn to cash the Q2 earnings call, implying some have positive equity even under current conditions, which also indicates the 10% cap rate projection is not representative of reality.

Q: Got it. That's helpful. And then where do asset sales fit into this equation? And why wouldn't that be a good source of liquidity for you today?

A: That's a good question. We -- prior to me stepping into this role, the company had marketed a couple of assets that have, in our opinion, significant equity value to get a market check and to see if that was a source of capital that we wanted to raise. The company decided obviously to pull those back given the -- how dramatically lower those values were than pre-COVID prices. So those weren't really particularly attractive. I think it's something that we'll -- they're not entirely off the table. But as I sit now, it's a lesser of a priority. We've got a variety of different capital raising options we're looking at and investigating. And that may be a part of it. It's just right now we've got kind of enough other things that we're focused on that frankly, I think, are more substantive and can give -- raise more substantive capital than asset sales. But as we continue to go down the path with our lenders, and we'll see, we just don't -- it's not a focus right now.

Contrast the potential values (8-10% cap rates) to the implied value of the residual today. The $1.00/share price is the output if the total market value of both equity instruments is the value of the residual equity if all ~126m shares that can be issued in the exchange offer get issued. Even the prior pessimistic presentation slide from management implies $260m to the prefs in a liquidation at a 10% cap rate.

Exchange offering: The management is pushing an exchange offer for the preferreds by October 30th. It was initially 1.74 shares if you don’t agree or 5.58 shares or $7.75 in cash if you do. Now you can just sit on the prefs based on changes released on October 2nd or exchange it for common/cash.

There’s at least one distressed real estate fund that doesn’t want the exchange to happen on its initially proposed terms. What will be interesting is to see who actually owns the preferred and common shares now. The people who wanted the dividend on the common and preferred have all sold. This might already be shark territory and AINC doesn’t realize it, or at least they didn’t until the past few weeks. Common shareholders rejecting the October 6th vote allowing management to issue shares in the preferred exchange may or may not happen. If it doesn’t succeed the equity represents a very tiny sliver and the preferreds remain intact with the potential to return to par. If an exchange does occur, the resulting equity sliver will still have an asymmetric payoff.

I will assume every preferred share wants cash, which means everyone will get a mix of cash and shares. It is $7.75 in cash or 5.58 in shares. If everyone wants cash each preferred gets $1.32 in cash and the remainder in shares. The way I calculate the conversion factor is $7.75 divided by 5.58 to get the cash equivalent share value, which is 1.388 (this may be incorrect). If everyone gets $1.32 in cash, that leaves $6.43 in cash equivalent in shares, which is $6.43/1.388 or 4.63 shares. 4.63 multiplied by 22,589,393 total preferred shares outstanding is another 104,448,813 common shares.

In this scenario there will be 114,610,813 total shares outstanding. Each preferred gets 4.63 shares and $1.32 of cash. Considering that the preferreds are getting flushed and trade for ~$5.00, one is paying $3.68 for 4.63 shares of AHT or $0.80/share and getting $1.32 in cash. The implied market cap through the preferreds where everyone elects for cash is $140m. This is for a potential residual value ranging from $0 to $960m ($380m NOI at 8% cap rate less $3.7bn debt). If the exchange doesn’t occur, the prefs still have a lot of coverage to potentially get back to par over the next 12-36 months). If the exchange occurs, making the prefs and common the same, the implied value is ~$140m versus a $0-960m payoff.

The common votes to issue the shares on October 6th and the exchange offer for the prefs expires on October 30th. The exchange was originally closing on the 9th, but they seem to be having trouble procuring the $30m that the exchange offer is contingent on. They also removed the requirement that 66 2/3% of the preferreds have to approve of the exchange. This makes the situation more fluid and the above calculations far more impressionistic than realistic because I don’t know how the votes will be cast or the number of shares issued in the pref exchange.

Activist: The activist involvement of Cygnus Capital/Chris Swann makes this interesting because the outcome is inherently path dependent. The maximum payoff scenario faces a lot of resistance from management, so the presence of an activist offsets some of this unfavorable weighting to the upside scenarios, albeit not close to entirely. The recent activity through 10/2 gives some hope they might pressure AINC to pitch in by cutting fees to help reduce the cash burn at Ashford, which would also be a positive for the common and prefs.

The firm’s origin was in buying distressed real estate loans from banks in the Southeast and they do not appear to be a public equity focused firm, so they likely understand the interesting risk/reward the debt structure presents. To the extent that they have a strong real estate creditor/workout perspective, their presence is noteworthy compared to an equity tourist like myself. They own 8.3% of the common and ~600k shares of the prefs.

Interesting to note, per the 13D, the swan dive personally into some options on the stock with a $5 strike for December 2020 and March 2021 and common shares outside to the tune of ~$1m between Chris and his family.

The Shares purchased by Mr. Swann personally, including Shares held in an IRA Account in Mr. Swann’s name, and held by members of his immediate family, which Mr. Swann is deemed to beneficially own, were purchased with personal funds (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business) in open market purchases. The aggregate purchase price of the 172,000 Shares, including 100,000 Shares held in an IRA account in Mr. Swann’s name, beneficially owned directly by Mr. Swann is approximately $532,618, including brokerage commissions. The aggregate purchase price of the 206,625 Shares, including 70,000 Shares underlying certain call options, held by members of Mr. Swann’s immediate family, which Mr. Swann is deemed to beneficially own, is $488,935, including brokerage commissions.

Conclusion: It’s an option, which often expire worthless.

I am most inclined to the Series D of the prefs because it has the highest coupon, to which no value was being ascribed as the market has been pricing in a full exchange, which valued the prefs equally. On the flip side, it is the smallest issue, making it more likely to be less liquid, so it might be a wash.